Fifteen years on ... and a new beginning

A new story of opening rather than closing

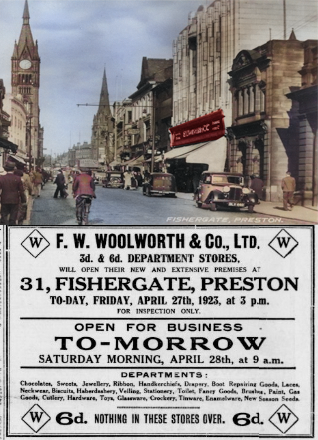

A century ago: A fresh start in the UK in 1924 as FWW turned 15

1924 marked FWW's 15th birthday in the UK. Its first local MD Bill Stephenson was at the helm. He'd been hand-picked by the Founder, who he had served as a clerk at a Birmingham supplier to the 5 & 10¢ in the 1900s. He had recently moved his two flagship stores in Liverpool and Preston, to elegant premises built to the the firm's specifications by its own people. They had opened to acclaim several months early.

1924 marked FWW's 15th birthday in the UK. Its first local MD Bill Stephenson was at the helm. He'd been hand-picked by the Founder, who he had served as a clerk at a Birmingham supplier to the 5 & 10¢ in the 1900s. He had recently moved his two flagship stores in Liverpool and Preston, to elegant premises built to the the firm's specifications by its own people. They had opened to acclaim several months early.

1924 also allowed Stephenson to fulfil a promise that he had made to Frank Woolworth back in 1917. The Founder had also wanted superstores in London to match the grandeur of his pride-and-joy in Fifth Avenue, New York. One had to be near London's other Yankee emporium Selfridge's in Oxford Street. Harry and Frank had first met in Chicago. The other shop would nestle between the Barkers, Pontings and Derry and Toms in fashionable Kensington High Street. At the time the British MD, Frank's cousin Fred, had vetoed the plans as too extravagant. Stephenson had to wait until he was the boss. The results were spectacular. They were well received by investors, suppliers and commentators, and inspired a rare overseas trip by Frank's brother, Charles Sumner Woolworth who had succeeded him as chairman of the Board, accompanied by the Company Treasurer Byron Miller, who had served on the London Board for a decade before being recalled to take on the dual roles of FD and VP with special responisbility for overseas operations. The visitors were impressed by the two new stores. Their next stop took them across the Channel and onto the Continent, to explore Miller's grand plan for Germany.

Miller had been drawn to Germany by the Chicago Banker, Charles G. Dawes, who had been tasked with fixing the country's economy so it could resume the reparations imposed after losing the Great War. He wanted US firms to invest there. The FD had been grappling with how to boost the efficiency of FWW's German sourcing which was missing Frank Woolworth's guiding hand. Miller felt a German subsidiary could map a global supply chain by rebuilding the warehouse in Sonneberg and updating Fuërth, before shaping a new store chain for the Weimar Republic.

Miller had been drawn to Germany by the Chicago Banker, Charles G. Dawes, who had been tasked with fixing the country's economy so it could resume the reparations imposed after losing the Great War. He wanted US firms to invest there. The FD had been grappling with how to boost the efficiency of FWW's German sourcing which was missing Frank Woolworth's guiding hand. Miller felt a German subsidiary could map a global supply chain by rebuilding the warehouse in Sonneberg and updating Fuërth, before shaping a new store chain for the Weimar Republic.

Miller and Woolworth were certain that the brand would strike a chord with Germans, particularly if it followed the pattern of Frank's early Stateside shops, which had concentrated on everyday essentials at jaw-drop prices for the home, kitchen and bathroom, along with notions (Haberdashery) and simple stationery. Any displays of ornaments, toys and luxuries would be kept small until family incomes started to grow as the economy improved. They feared that they would meet with resistance from Company President, Hubert Parson, even though he was well aware that German shops had been his former boss and mentor's dream. Returns were falling at home, making the parent increasing dependent on profits from the UK, prompting Parson to keep capital spend down.They would have to convince him that Germany was the answer to his prayers.

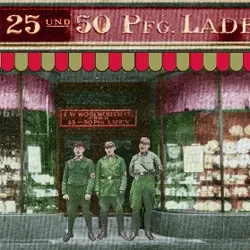

New York marks the 15th anniversary of going public with the F.W. Woolworth 25 und 50 Pfennig Stores in Germany

Parson gave in, making German-American executive Richard H. Strongman the first Geschäftsführer (MD) as proposed. He duly incorporated the company in 1926 and hired its top team, choosing locals Ivan W. Keffer as his No. 2, and Rudolph Jahn, who had trained at FWW USA before taking a role at its Sonneberg Warehouse in Germany when it opened in 1920. The three reimagined that facility as the super-efficient hub for New York's global sourcing and oversaw the work.

Parson gave in, making German-American executive Richard H. Strongman the first Geschäftsführer (MD) as proposed. He duly incorporated the company in 1926 and hired its top team, choosing locals Ivan W. Keffer as his No. 2, and Rudolph Jahn, who had trained at FWW USA before taking a role at its Sonneberg Warehouse in Germany when it opened in 1920. The three reimagined that facility as the super-efficient hub for New York's global sourcing and oversaw the work.

Once reconstruction began, the Directors scouted the country, visiting each major town and city in turn and applying the time-served process defined by Frank Woolworth. It measured the amount of foot traffic on the main streets, the current and forecast population and the key industries to determine which places would suit a Woolworth's and whereabouts in town it should be. Normally the chosen spot was near a transport hub, close to other shops and in a town or city with manufacturing and heavy industry or docks and freight yards employing lots of people. As they travelled, it was clear that Germany was ready and had huge potential. When a town fitted, before leaving they searched for any vacant buildings near their chosen spot, or failing that tried to persuade an extisting trader to sell-up and retire. With the tour complete they pulled together a masterplan for the openings. The new chain would be a birthday present for New York, as 1927 marked the Fifteenth Anniversary of its Wall Street listing in the $65m merger. They advised Executives to tell investors, "Here we grow again."

New York approved the plans as written, instructing "proceed without delay". The northern port city of Bremen was 'Ground Zero', quickly followed by Barmen, Bochum, Wiesbaden, Dortmund, Hamborn, and Duisburg, finishing in Berlin within a year. Six months after the sign-off, a marching band and orchestra welcomed customers to a preview at 26-28 Faulenstrasse at 2.30pm on Friday 29th July, 1927. Trading began at 8.30am the next day, and broke all records. Larger view..

New York approved the plans as written, instructing "proceed without delay". The northern port city of Bremen was 'Ground Zero', quickly followed by Barmen, Bochum, Wiesbaden, Dortmund, Hamborn, and Duisburg, finishing in Berlin within a year. Six months after the sign-off, a marching band and orchestra welcomed customers to a preview at 26-28 Faulenstrasse at 2.30pm on Friday 29th July, 1927. Trading began at 8.30am the next day, and broke all records. Larger view..

For five years the new-born company was Woolworth's wonder-child, expanding its chain, sales and profit far faster than any country had achieved before. Directors later described the period as "Der große Errfoig, or "The Great Success". But then the bubble burst. Intense competition from fixed price shops had disrupted the market. It came not only from Woolworth but from look-alikes, Epa, Ehape and Wohlwert (craftily named how most Germans would naturally pronounce the name above FWW's door). It spooked both the competition, and a rapidly-rising popular politician who hated foreign firms taking trade from Germans and sending the profit home. His name was Adolf Hitler. In 1932 the Reichstag, Germany's parliament, passed a law banning fixed priced stores from opening any more outlets. MD Strongman was able to use Woolworth's huge supplier base, cash purchases of goods for export to New York, and projects already in progress, to obtain a temporary exemption until the end of the year, when he chose to retire. He passed the baton to his number two, Ivan Keffer on 1 January 1933, the day the firm moved into plush new offices in Bellevuestrasse II, Berlin, W.9. The new Geschäftsführer faced a rocky road ahead, particularly after the Reichstag mysteriously burnt down in July, completing Hitler's rapid rise to absolute power and the supremacy of his National Socialist Party.

New York was unimpressed when Ivan Keller sent an enquiry from the Commerce Ministry asking if any Director in New York or Berlin was Jewish. They replied that their Board consisted of Methodists, along with two Catholics and a pair of aetheists. Berlin could answer for itself. Keffer duly updated the Ministry, receiving a terse acknowledgement for his satisfactory if rather tardy response.

But the protestors outside his largest stores didn't disperse. They simply swapped one set of placards for another. Instead of protesting about possible Jewish management, the new signs advised Germans to buy only from German shops and not to be taken in by Jewish propaganda about atrocities. Keffer's problems didn't end there. Every week there seemed to be new rules restricting his freedom to act and manage the business. By the end of 1935 he could not allow cash from F.W. Woolworth G.m.b.H. to leave the country, except in payment for approved imported goods. Returning profits to a parent company was explicitly prohibited by law. Foreign-owned companies were required by law to deposit any surplus cash in German-owned banks or invest it in German-owned businesses.

By 1938 the parent company had sacrificed more than fifteen million reichsmarks ($6m) in unpaid dividends and thought it best to move their loyal MD, Ivan Keffer, who had repeatedly riled the German authorities, out of harm's way to the Executive Office HQ in Toronto, Canada. They tried to place control of most aspects of German operation in the hands of their local lawyers, but the arrangement did not meet with approval from the authorities, which instructed Rudolph Jahn, rated a loyal citizen, to take the helm. It fell to him to chart a way forward. He had to try to maintain morale as the nation went to war, keep trading as shopping streets faced enemy bombardment, and after the Allied victory in 1945 put it all back together, a piece at a time. By the time the conflict finally ended, both warehouses and the great majority of stores had been obliterated from the face of the earth, forcing New York to reduce the value of the subsidiary to a single dollar in its accounts. Jahn led the firm with great skill and resolve for over a quarter of a century. When he retired in 1964 he had served forty-five years as an Executive, including 39 as a Director and 26 as MD. Across the globe no other individual, not even the Founder, faced and mastered more challenges in office. Jahn richly deserves his place in the Woolworth Hall of Fame.

A new way forward, announced 15 years after World War II.

Much of the plan had its roots in Europe.

In 1959 Executives from across the globe converged on the Dorchester Hotel in London's Park Lane to celebrate the British subsidiary's 50th Birthday and to be briefed on the new President's plans for the 1960s at a lavish banquet.

In 1959 Executives from across the globe converged on the Dorchester Hotel in London's Park Lane to celebrate the British subsidiary's 50th Birthday and to be briefed on the new President's plans for the 1960s at a lavish banquet.

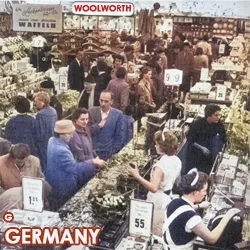

Robert Kirkwood heaped praise on Rudolph Jahn for creating a new wonder child in Germany, declaring that the veteran had "built back better."

Jahn had proved that Woolworth could sell more upmarket ranges, securing a big market share for his family fashions which had great designs at low prices. He still gave great value, but on stylish garments to be proud of. The UK got praise too. 'Woolies' had gone from strength-to-strength since the War. It had added 350 branches, breaking the thousand mark in 1958, and had also extended or relocated 100 pre-war stores.

He was particularly impressed by London's new ranges of "Do-It-Yourself", which reinvented the traditional tools, paints, brushes and polishes which had originally targeted tradespeople, to suit homeowners and tenants alike. Its stylish new tableware patterns had got the thumbs up from the press, attracting more affluent customers to prettify their kitchens as well as the traditional clientele. The latest Homemaker and Hedgerow styles were made by new machines without the need for costly hand-painting which boosted quality and kept prices low. Looking upwards in-store, replacing incandescent lighting with flourescent tracks had been a masterstroke that made everything look brighter and helped "shoppers to see Woolworth in a whole new light!" The 47% of the business that was listed on the London Market had rocketed to its number two slot, with only Imperial Chemical Industries (ICI) valued more highly. He was grateful to the Boards in London and Frankfurt for contributing so many elements to his new strategy. He invited everyone to raise a glass to his two wonder children. Then his tone became much more intense as he demanded that British executives face up to major changes ahead.

They must prepare for new competition. It had already hit in the USA. An intense price-war had forced FWW to accept a much lower margin. Newcomers' premises were more modern and cheaper to heat, light and staff, thanks to self-service and easy-to-fill counters. The UK should get ahead, moving from old High Street sites to Malls and quickly converting every branch to self-service, before focusing on a new trend, out-of-town shops on industrial parks and ring-roads. They would soon lure working people with cars and vans to a great value one-stop shop and day out.

They must prepare for new competition. It had already hit in the USA. An intense price-war had forced FWW to accept a much lower margin. Newcomers' premises were more modern and cheaper to heat, light and staff, thanks to self-service and easy-to-fill counters. The UK should get ahead, moving from old High Street sites to Malls and quickly converting every branch to self-service, before focusing on a new trend, out-of-town shops on industrial parks and ring-roads. They would soon lure working people with cars and vans to a great value one-stop shop and day out.

He concluded by saying, "Here in Britain,, today you are at the top of market. Embrace these changes now and you will still be ahead in another fifty years. Fail, and in ten years you may find yourself in in terminal decline. In Germany you're lucky, the market is less mature and you're ahead of it, so you have the luxury of waiting and learning from the UK in five or ten years' time. But be aware that change is coming and prepare as much as you can. In the USA we will be diversifying, acquiring new businesses to help us break into the fashion and shoe industries and electricals too. Soon we will source raw materials, manufacture in our own factories, ship everything on our trains and trucks, and offer values that shoppers can't find anywhere else. As the world's largest retailer, we will be able to afford to keep on updating for growth, while still paying generous dividends that keep investors loyal."

He concluded by saying, "Here in Britain,, today you are at the top of market. Embrace these changes now and you will still be ahead in another fifty years. Fail, and in ten years you may find yourself in in terminal decline. In Germany you're lucky, the market is less mature and you're ahead of it, so you have the luxury of waiting and learning from the UK in five or ten years' time. But be aware that change is coming and prepare as much as you can. In the USA we will be diversifying, acquiring new businesses to help us break into the fashion and shoe industries and electricals too. Soon we will source raw materials, manufacture in our own factories, ship everything on our trains and trucks, and offer values that shoppers can't find anywhere else. As the world's largest retailer, we will be able to afford to keep on updating for growth, while still paying generous dividends that keep investors loyal."

British Managers outnumbered their overseas guests by more than twenty to one. Hardly a single person applauded at the end of Kirkwood's speech. He had come to their party as an honoured guest and had "pooped on their parade. " Throughout the Sixties the British Board resisted the President's recommended changes, doing only the minimum they could get away with, and instead pursuing diversification ideas of their own. By 1969, as their guest had predicted, profits were in steep decline, and the country's belated decision to decimalise its currency after a thousand years and prepare to join the European Economic Community, left their cash reserves at an all time low.

1982: Staving off disaster

Unplanned fallout from R.C. Kirkwood's 60s Diversification

Woolworth received an unwelcome birthday present as it celebrated its centenary in 1979. For the first time in a hundred years of trading, it faced a hostile takeover bid for the entire business from a much smaller, opportunistic Canadian company called Brascan. The bidder claimied that the giant had been asleep for years and had seen its profit and return of investment fall ever lower. Woolworth assured investors that everything was fine and they had exciting new plans for the 1980s which would see sales and profit rocket. No such plans existed, and everything was far from fine. Robert Kirkwood had planted a time bomb in 1958, had loaded it with high explosive in the early 1960s and had hidden it in plain sight in the company's accounts where it seemed successive CFOs couldn't see it. And the bomb was about to go off.

Woolworth received an unwelcome birthday present as it celebrated its centenary in 1979. For the first time in a hundred years of trading, it faced a hostile takeover bid for the entire business from a much smaller, opportunistic Canadian company called Brascan. The bidder claimied that the giant had been asleep for years and had seen its profit and return of investment fall ever lower. Woolworth assured investors that everything was fine and they had exciting new plans for the 1980s which would see sales and profit rocket. No such plans existed, and everything was far from fine. Robert Kirkwood had planted a time bomb in 1958, had loaded it with high explosive in the early 1960s and had hidden it in plain sight in the company's accounts where it seemed successive CFOs couldn't see it. And the bomb was about to go off.

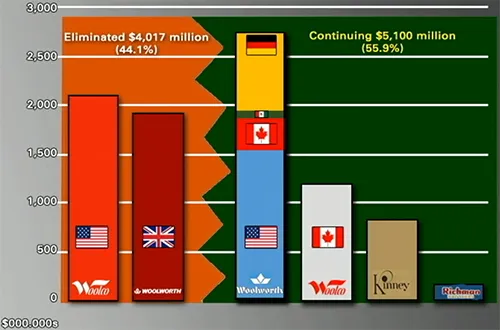

Kirkwood had financed his spending spree at the turn of the 1960s with a twenty year bond issue. Under its terms the company paid only nominal interest each year, but committed to return the original investment with a large bonus at the end of the term. The main expense was Woolco. Its stores had generated reasonable sales (but under half the amount per foot of Sebastian S. Kresge's K-Mart or Target Discount) and had paid dividends on a modest profit each year, but made no provision to pay off the loans which had financed its set up costs. Even the latest turnaround plan considered such a feat to be impossible. Sacrifices would be needed to clear the debt.

Kirkwood had financed his spending spree at the turn of the 1960s with a twenty year bond issue. Under its terms the company paid only nominal interest each year, but committed to return the original investment with a large bonus at the end of the term. The main expense was Woolco. Its stores had generated reasonable sales (but under half the amount per foot of Sebastian S. Kresge's K-Mart or Target Discount) and had paid dividends on a modest profit each year, but made no provision to pay off the loans which had financed its set up costs. Even the latest turnaround plan considered such a feat to be impossible. Sacrifices would be needed to clear the debt.

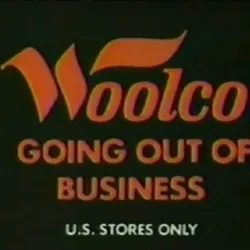

In 1982, just weeks after newly hired Out-of-Town MD Bruce Allbright announced that he would be hiring new Buyers for the chain in preparation for the first stage of his turnaround strategy, the Main Board announced out-of-the-blue that every Woolco across the USA would be closing, All of the merchandise. fixtures amd even the buildings would be sold, and the loyal staff, many of whom had ten to twenty years' service, would be paid generous severance to leave their jobs. The media described the movve as "The biggest business failure in the USA since L.R. Grant", which had been forced into bankruptcy in a New York court. Walmart acquired the non-unionized stores and most of their staff. In Main Street, the traditional Woolworth Stores were left feeling bereaved without their 'big brothers'.

Days later the other shoe dropped, shocking Analysts for a second time. The Board had agreed to sell its controlling 52% stake in British Woolworth to a local consortium for $500m. After 80 years of sending half of its profit to New York to repay the original £50,000 seed capital, the UK would be "set free". The Directors who brokered the deal, President Ed Gibbons and Overseas Director Richard L. Sullivan, shielded the Board from the fact that it was an aggressive 'management buy in' by private investors, leaving most believing it was a mutually agreed "MBO". Paternoster, (later renamed Kingfisher plc) pioneered the playbook that would later be adopted by venture capital turnarounds. At Woolworth they drove out costs, excess stock and bureaucracy and reshaped the asset register to release cash to repay their backers, before embarking on a spree of acquisitions alongside accelerating existing plans to expand B&Q as the heart of a new market-leading out-of-town DIY division purchased in 1980.

Days later the other shoe dropped, shocking Analysts for a second time. The Board had agreed to sell its controlling 52% stake in British Woolworth to a local consortium for $500m. After 80 years of sending half of its profit to New York to repay the original £50,000 seed capital, the UK would be "set free". The Directors who brokered the deal, President Ed Gibbons and Overseas Director Richard L. Sullivan, shielded the Board from the fact that it was an aggressive 'management buy in' by private investors, leaving most believing it was a mutually agreed "MBO". Paternoster, (later renamed Kingfisher plc) pioneered the playbook that would later be adopted by venture capital turnarounds. At Woolworth they drove out costs, excess stock and bureaucracy and reshaped the asset register to release cash to repay their backers, before embarking on a spree of acquisitions alongside accelerating existing plans to expand B&Q as the heart of a new market-leading out-of-town DIY division purchased in 1980.

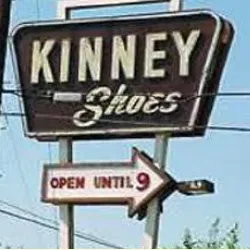

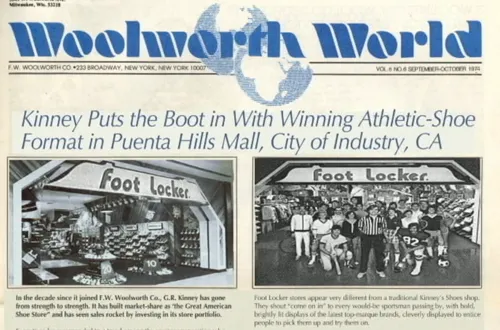

Despite its flaws, overall Kirkwood's approach achieved its goal. His strategy of sowing lots of seeds in the garden and seeing which ones grew worked. One acquisition, Kinney Shoes, was given the space to reimagine itself. It came up with a new format which stood head and shoulders above all the chain's other new fascias - capturing the public's imagination around the globe with its extraordinary range of Athletic shoes. Today Footlocker Inc. continues to pay dividends to investors who first bought F.W. Woolworth Co. shares back in 1912. It can trace its heritage right back to 1879. Our picture shows the moment when Kinney's big idea was first shared with the chain almost 50 years ago.

Despite its flaws, overall Kirkwood's approach achieved its goal. His strategy of sowing lots of seeds in the garden and seeing which ones grew worked. One acquisition, Kinney Shoes, was given the space to reimagine itself. It came up with a new format which stood head and shoulders above all the chain's other new fascias - capturing the public's imagination around the globe with its extraordinary range of Athletic shoes. Today Footlocker Inc. continues to pay dividends to investors who first bought F.W. Woolworth Co. shares back in 1912. It can trace its heritage right back to 1879. Our picture shows the moment when Kinney's big idea was first shared with the chain almost 50 years ago.

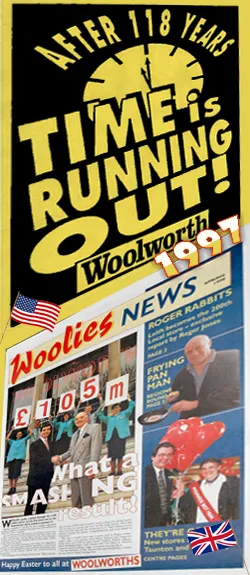

1997: the shutters fall at an American icon

Emergency surgery fifteen years earlier had failed to save US Woolworth

After 1982 most leaders made heavy cuts to Woolworth in the US. But a couple preferred to seek a turnaround, trying a hybird Woolworth Express format, new IT, a reshaping in Hawaii, and in 1996 outsider Roger Farrah tested a statewide rebrand in Delaware. In 1997 the CEO admitted defeat. Trial store sales and profit were well up, but returns per dollar invested were only a third of the level achieved by Footlocker. He had concluded that it was time for Woolworth to retire with grace and honour after 118 years.

After 1982 most leaders made heavy cuts to Woolworth in the US. But a couple preferred to seek a turnaround, trying a hybird Woolworth Express format, new IT, a reshaping in Hawaii, and in 1996 outsider Roger Farrah tested a statewide rebrand in Delaware. In 1997 the CEO admitted defeat. Trial store sales and profit were well up, but returns per dollar invested were only a third of the level achieved by Footlocker. He had concluded that it was time for Woolworth to retire with grace and honour after 118 years.

The Company would "do right by its people". They would have time to say good-bye. Where possible a sister brand would take on the premises to save jobs. Everyone else would get enhanced severance, outplacement support and members the chance to draw their pensions early. He would also find a way of helping the German and Mexican Boards to launch buyouts. They were profitable and self-sufficient and could continue. Americans were shocked at losing the iconic " 5 and 10¢". But most observers acknowledged that the exit was handled with kindness and sensitivity.

The Company would "do right by its people". They would have time to say good-bye. Where possible a sister brand would take on the premises to save jobs. Everyone else would get enhanced severance, outplacement support and members the chance to draw their pensions early. He would also find a way of helping the German and Mexican Boards to launch buyouts. They were profitable and self-sufficient and could continue. Americans were shocked at losing the iconic " 5 and 10¢". But most observers acknowledged that the exit was handled with kindness and sensitivity.

2008: FWW UK becomes the defining failure of the credit crunch

...and Germany gets caught in the cross-fire in 2009

The collapse of Leham Brothers on September 15, 2008 sent shockwaves around the globe. Soon banks stopped lending to each other, and began to weed out their weakest clients. Woolworths UK was particularly vulberable after a series of errors culminated in replacing the Group CEO days after he had negotiated new loan arrangements. At a time when the main High Street stores were making a loss, news that a new man would replace the strategy shared with the lenders with a turnaround around plan made them apoplectic. Spotting the problem, the niche credit insurers who provided suppliers with a safety-net when they offered extended credit terms to their customers, withdrew cover forcing the High Street chain to pay up-front instead of getting its standard 90 days' free credit. Despite frantic efforts to liquidate old stock and cancel outstanding orders, unless the bankers increased their loans, collapse became inevitable. The new CEO rated his turnaround plan a no-brainer, but the lenders rejected it out of hand,

The collapse of Leham Brothers on September 15, 2008 sent shockwaves around the globe. Soon banks stopped lending to each other, and began to weed out their weakest clients. Woolworths UK was particularly vulberable after a series of errors culminated in replacing the Group CEO days after he had negotiated new loan arrangements. At a time when the main High Street stores were making a loss, news that a new man would replace the strategy shared with the lenders with a turnaround around plan made them apoplectic. Spotting the problem, the niche credit insurers who provided suppliers with a safety-net when they offered extended credit terms to their customers, withdrew cover forcing the High Street chain to pay up-front instead of getting its standard 90 days' free credit. Despite frantic efforts to liquidate old stock and cancel outstanding orders, unless the bankers increased their loans, collapse became inevitable. The new CEO rated his turnaround plan a no-brainer, but the lenders rejected it out of hand,

Had the scheme been accepted, it would have seen the group split into two, with the Entertainment Publishing and Wholesaling businesses continuing with the same lenders, and Woolworths sold for a nominal sum to the retail recovery specialists Hilco, which would inject new capital, and work with Commercial MD Tony Page and some of the other High Street Directors to build a value offer centred on his successful Worth-It! range which had attracted a million new shoppers to the High Street each week. The Board had expected Deloitte to speak in favour of the plan which they had developed and validated, and were disappointed when the Administrator announced that as its duty was to represent the lenders and the employees it would remain neutral. Despite intense negotiations the lenders did not accept the plan, simply demanding repayment of all outstanding loans at once, forcing Deloitte to break the business up and try to save or sell it a piece at a time.

Within three weeks, Deloitte concluded that not even big names like Lord Sugar or Theo Paphitis could raise the funds required for a bale out in the current market, meaning it would not be possible to sell the whole Group or its divisions as going concerns. An orderly shutdown of the shops and the wholesale business began, alongside negotiations to sell the Group's 40% music publishing stake and its trading names. Soon the clearance sale included fixtures as well as products, priced to clear quickly so the stores could close before the new year's rents fell due after Christmas. Built over 99 years, opening its last store only a week before going bust, Woolies was annihilated from the High Street in just 42 days. A week after the shutters fell came the final indignity. Negotiations with former MD Tony Page to save some stores in the north of the UK were terminated when Deloitte announced that a world class retailer had bought the Woolworths and Ladybird brand, which would re-emerge on-line. Shop Direct (later Very) Group added that it would not permit any 'look-alikes' in the High Street to dilute the on-line offer. Woolworths had "ascended".

Within three weeks, Deloitte concluded that not even big names like Lord Sugar or Theo Paphitis could raise the funds required for a bale out in the current market, meaning it would not be possible to sell the whole Group or its divisions as going concerns. An orderly shutdown of the shops and the wholesale business began, alongside negotiations to sell the Group's 40% music publishing stake and its trading names. Soon the clearance sale included fixtures as well as products, priced to clear quickly so the stores could close before the new year's rents fell due after Christmas. Built over 99 years, opening its last store only a week before going bust, Woolies was annihilated from the High Street in just 42 days. A week after the shutters fell came the final indignity. Negotiations with former MD Tony Page to save some stores in the north of the UK were terminated when Deloitte announced that a world class retailer had bought the Woolworths and Ladybird brand, which would re-emerge on-line. Shop Direct (later Very) Group added that it would not permit any 'look-alikes' in the High Street to dilute the on-line offer. Woolworths had "ascended".

Despite the hype at its launch shortly before the brand's centenary in November 2009, the new website was just a shadow of the former woolworths.co.uk. It shared a range, infrastructure and basic proposition with the new owners' existing legacy Littlewoods.co.uk, repainted in Woolworths colours and with a bizarre sweets offer that could be neither picked nor mixed. Throughout its time on-line Very's Woolworths.co.uk never came close to matching the £100m turnover achieved online by the High Street company in its final year, after it integrated its Big Red Book, a Till-based Ordering App and its website to create a true multi-channel retail proposition. As the initial marketing campaign was scaled back, sales fell steadily. In 2015 Very Group quietly retired the website to concentrate its energies on upgrading its world-class very.co.uk brand. From then until the end of 2023 the URL took former Woolies customers straight to Very.co.uk.

Some believe that it was the failure in the UK that led the credit insurers to withdraw cover from the German Company. In 2007 it had been acquired by London-based Argyle Capital Partners and Cerberus Capital of New York who had set about implementing a well considered restructuring plan. But they could only sustain paying up-front for goods for a few days before having to seek bankruptcy protection. German law follows the American model, affording a period of protection from creditors to allow a business to reorganise and restructure to save jobs. This gave time for a white knight to emerge with a plan to salvage a sizeable part of the business. The family-owned value retailer Tengelmann offered to save around 150 stores in larger towns and cities and sharpen their value proprosition. It would also cut overhead costs by closing the huge and expensive administration office complex in Frankfurt and intially would use existing Suppliers to get back up and running quickly.

The new owner was unable to save the recently developed new convenience chain of mini-Woolworth stores in smaller towns. Those stores had lower footfall and higher operating costs. The new chain would offer a great value selection of items for the home, fashions for all the family, stationery and seasonables. Once the formula was proven it aimed to expand rapidly to locations in larger towns and cities acrosss Germany and beyond, with an aspiration to grow to over five hundred outlets over time, which would make Woolworth the largest it had ever been in Germany. Despite economic challenges in Germany and the pandemic, the makeover has consistently hit its targets, with the chain's store base, profit and customer traffic growing at a rapid rate while most other retailers have been in decline. In parallel with the openings programme it has established a new company culture, developing its own talent to support the opening programme, along with an ultra-efficient central administration and supply chain hub in Unna, with plenty of room to grow.

February 2024: "here we grow again"

The slogan from 1927 is even more appropriate today

Woolworth Germany has gone from strength to strength since Roman Heini took the helm in 2020. Today the company has 620 stores in Germany - more than ever before - with around twenty more in Austria and Poland. Today's branches carry around 10,000 lines, over 90% of which are own-brand and made to the Company's own specification. 6,000 of the lines cost €3 or less (£2.67), comprising mainly goods for the home, stationery, clothing basics for all the family and a selection of toys. The Company expects to break through €1 billion sales this year. In January 2024 Heini told Retail Week that the Company had recently acquired the rights to trade across Europe, including the UK and Ireland. He believes the Continent could support up to 5,000 Woolworth outlets in the future, and teased journalists that his pipe dream for the medium to long term is to re-open in the UK, where brand recognition remains exceptionally high. The Woolworths Museum wishes him every success in bringing that dream to reality as soon as he can. We can't wait.

More about Woolworth Germany and its plans

Potted history of F.W. Woolworth in Germany 1890 to 2024

January 2024: Superstar CEO Roman Heini shares his "pipe dream" for European expansion